Matching Form Release Agents to Application Methods: Part II

TECHNICAL DEPARTMENT:

Matching Form Release Agents to Application Methods

Part 2 of a 4-Part Series

By Destry Kenning, Forming Market Segment Manager, Nox-Crete Products Group

Formwork requires a considerable investment, but even the best forms cannot produce the best results unless they are paired with the proper form release agent. To prevent the adhesion of concrete on the face of forms, application of a form release agent is necessary. Additionally, a form release agent protects formwork, increases long-term durability and helps produce smooth, stain-free concrete surfaces with fewer defects.

There are many types of form release agents, and they have qualities that make them anything from good enough to great. A good release agent will allow the form panel to strip with little effort. A great release agent will make stripping the forms easy, keep the forms clean, extend the useable life of the forms, and be safe for workers and the environment. There are many factors, however, that come into play when bringing a release agent from good to great.

Choosing a great release agent is about so much more than knowing which stand-alone product is best. How it is used, when it is used, what it is used on and the method of application preferred by the crew must all be taken into account in order to choose the most practical and economical product for the job. This is easier said than done, when you consider the huge variety of form release agents currently available.

Options Abound

Options Abound

The good news about form release agents: There are many options. The bad news: There are many options, and this can make narrowing down to the right one more difficult. There are water-based and oil-based carriers, and that is just the beginning. Knowing exactly what is in the release agent is also important. For example, some oil-based release agents contain potentially hazardous recycled transformer oils. Used or recycled oils can contain harmful, and even carcinogenic, compounds that did not exist in the original virgin oil. Generally, water-based release agents require mixing, are susceptible to freezing and are more difficult to see on the form once the water evaporates. For these reasons water-based release agents are rarely used at the residential level.

In addition to the formulation base, release agents fall into the two basic categories of barrier and reactive, and the to kinds are not equally suited for every form substrate. As their names imply, barrier release agents create a physical barrier between the form surface and the concrete, and reactive release agents contain an ingredient that reacts with lime in the fresh concrete. Numerous formulas of form release agents are currently available in combinations of water or oil carriers with barrier, reactive, or a combination of barrier and reactive components.

The Right Formula for the Form

The form material on which the form release agent is applied is another factor in choosing the right product. One release agent might be good for aluminum forms but would not work so well on overlaid plywood — so it is important to know how each formula works. In the words of M.K. Hurd, the Concrete Construction editor and engineering pioneer: “Many form oils and other release agents adequately prevent sticking, but using the correct type of release agent for the form material can do much more. The right release agent properly applied can minimize color variations, staining, bugholes (blowholes), and poor form-surface durability. A good release agent should also be easy to apply evenly at the recommended coverage and should help to maximize form reuse.”

In other words, any release agent may get the job done, but the right release agent will achieve better results in the most economical way. After a large investment in forms and labor, why chance a high-quality outcome on a low-quality form release agent, or a release agent that just is not right for the job?

Best Practice vs. Common Practice

Best Practice vs. Common Practice

In an ideal world, a form release agent is sprayed onto the form prior to being set. The spray-before-set method works great when forms have no buildup. However, buildup is common, especially on aluminum forms, and it is best to apply a reactive/barrier release agent when the form is stripped. Otherwise, the buildup will continue to gain strength, likely leading to more buildup, and making it more difficult to remove later. Even old buildup on aluminum forms will soften with repeated use of a reactive release agent. Applying a reactive release agent immediately after stripping the forms gives the product more time to penetrate and soften buildup. On overlaid plywood forms, applying the release agent after stripping the forms will help retain moisture in the plywood, which reduces cracking that occurs when the panel dries rapidly and the wood fibers contract. This is especially important if forms are left out in the sun, as they often are while in use or in storage. On the whole, the spray-before-set or spray-after-strip methods will give you better results and will result in less form damage and less damage to the concrete surface.

These two methods may be best practice, but we all know there is often a big difference between the ideal way of doing things and the way they are actually done. At CFA’s Concrete Foundations Convention 2017 in Nashville, contractors were polled with this question: “How do you spray your forms?” Contractors could choose from three possible application methods: (1) spray before set, (2) top down, (3) spray after strip.

Most contractors said the “top down” application was most commonly used by their workers. When asked why workers preferred the top down method, contractors said it was to prevent having to handle a form that has been oiled. Workers who move oiled forms end up covered in the release agent they sprayed, which frequently contains reclaimed or unpleasant — and potentially hazardous — components. To avoid this, they walk the wall and spray the already-in-place forms from the top down. Again, workers prefer this method because they get less oil on themselves.

Here is where the real problems start. In order to be effective, the entire form must be coated with release agent. If the form exterior does not get evenly covered with release agent, it will develop buildup and could be damaged in the stripping process. Some applicators are aware of this, so when they apply a release agent using the top down method, they continue to spray release agent until they see it running out on the footing. This is a wasteful strategy, and it typically leads to inconsistent results, especially during colder weather conditions when release agent viscosities increase.

If contractors insist on top down application, then they should at least select the release agent best suited for this application method. For top down applications, a low viscosity release agent is crucial, especially in cold conditions. A low viscosity formulation is easier to spray and can be applied in thin, even coats, reducing excess runoff.

Finally, consider the labor required to apply the form release agent. Hurd points out, “The agent’s ease of application is also important, since the labor needed to apply the material costs more than the material itself.” Laborious time spent scraping and trying to get forms cleaned can be mostly reduced by proper application before setting or after stripping, and by making an educated decision on which release agent works best for your forms.

The Cost of the Wrong Release Agent

Keep in mind that choosing an economical release agent does not always mean saving money overall. As Hurd states, “The cost of using a release agent is small in comparison to formwork costs. Therefore, omitting or selecting a release agent based on price alone is false economy, especially since using the right release agent can extend a form’s service life.” Well-maintained forms combined with the proper release agent will result in maximum reuse. The right release agent will reduce concrete buildup, improve the cast concrete appearance, and reduce damage such as that caused by pry bars when forms stick.

Another way the wrong release agent can increase your costs is in fines for non-compliance. It is important to be in compliance with federal, state and provincial volatile organic compound (VOC) regulations, which protect against air pollution. The federal limit for VOCs in a release agent is 450 grams per liter. This means that diluting a release agent with a carrier such as diesel fuel or kerosene at a one-to-one rate will exceed the federal regulation and is subject to a fine of anywhere from $100 to $50,000 per violation per day. The VOC regulations and related fines for non-compliance can vary from state to state, so be certain to rule out non-compliant options from the start.

When it comes time to choose the best release agent for the job, carefully consider the form release agent composition and the method of application. A low quality release agent or any improperly applied release agent has the potential to stain or damage resulting concrete surfaces and can potentially damage the forms. In the end the best release agent will be easy to apply, safe to use, and will be compliant with VOC regulations in your area. It will also provide a combination of good economy, good concrete appearance, and the lowest form maintenance costs for your specific requirements.

Works Cited: Hurd, M.K. “Choosing and Using a Form Release Agent.” Concrete Construction, 1 Oct. 1996.

Letter from the Director: Thoughts from my Desk…

Thoughts From My Desk…

Throughout the 26th volume of Concrete Facts magazine, I will be sharing insights from the many interactions I have with members, non-member companies and the general public. My goals are first, to show you how the challenges faced are universal throughout North America, and second, to use these interactions to help steer this Association and industry into a much tighter coalition of quality and excellence.

Did you catch the Monday Morning Cup of CFA that was sent earlier this month relating the story of technical problem solving? It was brought about when a member faced scrutiny on a massive foundation project: the customer had wanted a monolithic pour and the contractor knew enough to stand firm on construction joints. The standoff ended through a combination of sound technical support for this decision-making and the contractor’s resolve to walk away from the project. Years of commitment to quality construction was not sacrificed for the allure of a larger paycheck or the prestige of a particular project.

I have been engaged for the past three weeks with a mechanical engineer having a new home built. Let’s just say that Google is by no means the best friend of the foundation contractor. This customer researched every last detail of the footings and foundations online, and brought up his findings. The contractor, perhaps a reputable company, has not satisfied the overly enthused customer’s curiosities and concerns. “Should I increase the wall thickness to 10 inches, instead of 8 inches, because of this condition? Money is no object.” Or, “I noticed the footing outside of the wall form they are setting is one inch more than the thickness. Should we move the wall or increase the thickness?” On and on the details of this project have been presented to me since the customer discovered a technical paper published on the internet. While these concerns are not warranted and are the results of a web-surfer applying rules, codes or decisions out of context, or without the whole story, only sound technical evidence would be effective in alleviating concern. Finally, the owner was satisfied that the foundation was sufficient, and he became gracious and patient. Concrete is now finally going in the wall. This will be a happy homeowner. However, the contractor missed out on adding technical knowledge and support to his toolbox for the next enthusiastic customer.

The two stories I have gone through show diametrically opposite positions wall contractors have taken. The first had an established relationship and experience accessing the technical knowledge and advocacy from this national organization. Because of this, he can regularly access the opinions of and share experiences with a trusted peer group, making his company bigger than it could have been alone. The second, although ending with a single successful project, will continue to face the pressure of clients one project at a time, without a large, qualified support system to advise and help him. CapitalOne is famous for the phrase, “What’s in your wallet?” If you are not a member of the CFA, we present to you the question, “Who’s in your corner?”

Peace to you,

James Baty

Letter from the President: Greetings from the new Pres!

Greetings, CFA Members and readers of Concrete Facts!

I would like to introduce myself to all of you who may not know me. I am Phillip Marone, President of Marone Contractors and affiliated companies. I am honored to have been selected by our Board too represent all of you as the next association President.

Our company has been members of the CFA since 1994 and I have been on the association board since 2005. That said, it sometimes amazes me how relevant our organization continues to be after so many years! Our recent Convention in July was full of fresh information and ideas. For those of you who have not attended in recent years you are certainty missing out on opportunities to improve your company’s position in an increasingly difficult environment to conduct business.

The education has been focused on relevant current challenges with regards to topics like safety, hiring, and dealing with the new generations of workforce. We also focused on traditional areas such as protecting your company legally, being compliant, how to think in different ways and a dose of technical education specifically concerning concrete testing. All the topics have kept the education fresh, informative and eye opening.

In other news, the Executive Committee has added Jason Ells, from Custom Concrete (Treasurer). His company has supported the CFA extensively over many years and the addition of Jason will help bring new and focused energy to our Organization. The remainder of the committee is Doug Herbert from Herbert Construction (Vice President) and Mary Wilson Michel Concrete (Secretary), along with myself and past President, Dennis Puriton, (Chairman).

It’s important everyone knows what a stellar job Dennis did as President! Dennis presented a lot of new and interesting initiatives to the Executive Committee and the Board.

What makes this notable, is that without dedicated people like Dennis, our group would find it very difficult to exist and likely wouldn’t. It is the work of the entire Board, the distinguished members of the newly formed Legacy Committee, past board members, and member companies that offer assistance beyond association dues, keeping the CFA vibrant.

We are a viable and relevant nonprofit group, with a voice in ACI because so many of our members, since the founding days in 1974, have dedicated much extra time and effort to keep us going and remain strong. They all deserve a special thank you!!

Best Regards,

Phillip Marone

Marone Contractors Inc

WANTED: Independent Sales Reps (National & International)

Seeking experienced, veteran Independent Sales Reps with concrete coatings knowledge. Applicant must have excellent customer service and follow up skills.

Professional Products Direct is a company developed with both the professional contractor and DIY customer in mind, selling only through qualified distribution channels. Professional Products Direct has gathered together some of the top talent in the industries of metal building products and concrete with over 75 years of combined experience to assist our distributors in sales, marketing and area specific product development. Professional Products Direct is a company that brings revolutionary new products with tried and tested results to professional tradesmen as well as DIY customers; we support our distributors with Professional Products, Professional Technology, and Professional Service. With the experience of the management staff that Professional Products Direct has brought on board, we are focused on becoming your one stop source for innovative professional product needs. Professional Products Direct’ s mission is to bring researched, market driven, high margin and easy to purchase product offerings to our authorized distributors.

Professional Products Direct is a company developed with both the professional contractor and DIY customer in mind, selling only through qualified distribution channels. Professional Products Direct has gathered together some of the top talent in the industries of metal building products and concrete with over 75 years of combined experience to assist our distributors in sales, marketing and area specific product development. Professional Products Direct is a company that brings revolutionary new products with tried and tested results to professional tradesmen as well as DIY customers; we support our distributors with Professional Products, Professional Technology, and Professional Service. With the experience of the management staff that Professional Products Direct has brought on board, we are focused on becoming your one stop source for innovative professional product needs. Professional Products Direct’ s mission is to bring researched, market driven, high margin and easy to purchase product offerings to our authorized distributors.

Please send resume along with references from 3 accounts that you have worked with to :

Rick Arons

Professional Products Direct

General Sales Manager

530-605-6846

rick@professionalproductsdirect.com

www.professionalproductsdirect.com

Obituary: Kristine Martinson (Dave Martinson)

It is with deep sympathy and sadness that we provide this obituary for the wife of Dave Martinson of Martinson Construction, Waterloo, Iowa. Kristine was present at many CFA events including the Concrete Foundations Convention year after year, often with their kids along for the fun.

Kristine J. Martinson, 52, of Cedar Falls, died Tuesday, June 19, 2018. She was born December 11, 1965 in Waterloo, Iowa, the daughter of Vern “Bud” & Madonna (Klassen) Blake. She married her high school sweetheart, David Martinson, on June23, 1990 at St. Patrick Church in Cedar Falls. Kristine graduated from Allen College of Nursing and the University of Iowa, receiving her Bachelor’s of Science in Nursing degree. She worked in nursing until retiring in 1995 and was a proud Mother.

Kristine J. Martinson, 52, of Cedar Falls, died Tuesday, June 19, 2018. She was born December 11, 1965 in Waterloo, Iowa, the daughter of Vern “Bud” & Madonna (Klassen) Blake. She married her high school sweetheart, David Martinson, on June23, 1990 at St. Patrick Church in Cedar Falls. Kristine graduated from Allen College of Nursing and the University of Iowa, receiving her Bachelor’s of Science in Nursing degree. She worked in nursing until retiring in 1995 and was a proud Mother.

Survivors include her husband, David Martinson of Cedar Falls; four children, Jonathan (Kenna), Andrea, Daniel (Calli Johnson) and Annaliese Martinson, all of Cedar Falls; her mother, Madonna Blake of Waterloo; two brothers, Don (Cindy) Blake and Steven (Rita) Blake, both of Cedar Falls; three sisters, Pam Rediger of Rockford, Illinois, Ann Fischer of Chandler, Arizona and Mary (Mark) Ratkovich of Waterloo; her Father and Mother in law, Jerry & Geraldine Martinson; brother in law, Scott (Julie) Martinson; two sisters in law, Lynne (Brad) Prentice and Jeane (Ron) Rabune; many nieces and nephews; three dogs, Lucy, Sparkle and Saige and her cat, Beaver.

Kristine was preceded in death by her father

A Celebration of Life will be 10:30 a.m. Friday, June 29, 2018 at Prairie Lakes Church with visitation from 4:00 to 8:00 p.m. Thursday also at the church. In lieu of flowers, memorials may be directed to the Kristine Martinson Memorial Fund at Veridian Credit Union. Dahl-Van Hove-Schoof Funeral Home is in charge of arrangements. Condolences may be left at www.DahlFuneralHome.com.

Kristine loved to take care of her husband, kids, dogs, and cat. She loved to travel with her family and friends and spend time on the river in Harpers Ferry. She enjoyed baking, working in her garden, and taking on many home improvement projects. She liked reading and gathering with her book club, going on long walks, exercising with her morning CrossFit group, going on bike rides, doing yoga and dancing. Kristine enjoyed volunteering at the St. Patrick’s Garage sale and finding all the deals with her girls at TJ MAXX.

Kristine will be remembered as the most loving wife, mother, sister, daughter, best friend, and second mom to many of her children’s friends. Kristine took pride in making her home somewhere that everyone wanted to be and everyone felt welcomed. She wore a constant smile that lit up every room, and her laughter was contagious. Her selfless spirit touched the lives of many as she took on countless roles that will be impossible to fill. Our queen for life.

Tim Neubauer Awarded Outstanding Safety Professional of the Year

[Raleigh, NC] – Tim Neubauer, President of Evolution Safety Resources, was granted the prestigious Outstanding Safety Professional of the Year Award from Columbia Southern University (CSU). The award was established in 2016 with the goal of recognizing members of the Occupational Safety and Health networkor their dedication, professionalism, and accomplishments within the industry. Although more than 170 CSU alumni and students were submitted for the designation, Tim’s nomination was approved in record time.“It was an easy decision to nominate Tim for this award,” explained Julia Kunlo, Vice President of Evolution Safety Resources. “He is a remarkably gifted safety professional that clearly embodies the ideals of the University. Tim works tirelessly to grow our company and mentor our team, so it was a true pleasure to take a step in recognizing him for all of his efforts. Although I completed the nomination, it was CSU professors and administrators who chose Tim out of the large pool of candidates – that says a great deal about his accomplishments in the field and his impact on the University.”

Tim is a Certified Safety Professional (CSP) with over 17 years of field experience who specializes in the construction health and safety field. He is a former Senior Consultant for the National Safety Council and has been a safety consultant and instructor for the Safety and Health Council of North Carolina for over fifteen years. These accomplishments are all the more impressive considering Tim started out as a laborer with a high school education. After entered the work force and discovering his passion for Occupational Safety, Tim worked full time while attending CSU to achieve his Bachelor’s degree in in the subject. He is currently pursuing his Master’s degree in the same field and is targeted to graduate in October.

“It is an incredible honor to have been nominated, and life changing to have won,” remarks Neubauer. “As a safety professional, I’ve spent my entire career hoping to make the workplace safer for everyone. This award is a true validation that I’ve impacted people’s lives and that my efforts have had a lasting effect. It means the world to me that I was submitted by a peer and that the CSU staff recognized my commitment to the industry. I plan to use the recognition this award generates to continue my mission of helping workers go home safe.”

Columbia Southern University published a full press release on Tim’s Outstanding Safety Professional Award, which can be found by clicking here.

About Evolution Safety Resources – Evolution Safety Resources is safety consultation firm that develops customized safety solutions for a wide client base. By offering a plethora of safety services (such as training, program development, ISNetworld/Avetta compliance, staffing, and more), ESR strives to reduce incident rates and ensure regulatory compliance.

Additional information on this topic is available at www.evolutionsafetyresources.com.

Tricks of the Trade – “Winter Scaffold Brackets”

This issue’s Tricks of the Trade is shared by a CFA board member in the spirit of continuing to share great ideas and to challenge you, the reader, to consider the ways you overcome annoying details and situations to be more effective and economical in your work. If you are from an active CFA member company and your trick is selected for publication, your company will have 50 points placed into your account for Member Rewards, redeemable for your CFA transactions. If you are from a company that is not a member, we will offer you a $100 discount on your first year’s membership fees — a great way to get to know the CFA.

While we continue to weigh the options we have for providing fall protection to our workers, we also contemplate the impact on the quality of our walls and the efficiency of our labor in achieving the results our customers deserve. One of the biggest differences we have seen is in the straightness and levelness in approaches to bracing walls. We have braced to the inside but the over-pin brackets available in the marketplace have given us nothing but fits. They don’t consistently fit, and they are unstable both in securing the brace and providing a walking surface for our crews.

While we continue to weigh the options we have for providing fall protection to our workers, we also contemplate the impact on the quality of our walls and the efficiency of our labor in achieving the results our customers deserve. One of the biggest differences we have seen is in the straightness and levelness in approaches to bracing walls. We have braced to the inside but the over-pin brackets available in the marketplace have given us nothing but fits. They don’t consistently fit, and they are unstable both in securing the brace and providing a walking surface for our crews.

This winter we set out to change that and came up with a quick design that incorporates the pin. Once we had the design down, we produced a whole series of them. Painting them yellow makes it easy for us to keep track of them. We added baskets into which they could be easily loaded, shipped to job sites, unloaded and maneuvered with our handling equipment without excessive labor.

The brackets hold 2-by-10 planks, and on a recent 80-

yard basement project, we needed only 7 braces to secure the walls with brackets on every interior form seam. The guys really like the ease of installation and the walls are perfectly straight. Our corners are still wrapped with 2-by-4 walers on the outside, but these brackets secure the inside and give us a consistent walking surface that does not shift or move under load. Our boards are 6-feet and 10-feet in length, and we use a full overlap at one bracket.

We are happy to discuss these brackets and how you too can use them to improve your fall protection and wall quality. Integrating the pin was our key to success in both.

We are happy to discuss these brackets and how you too can use them to improve your fall protection and wall quality. Integrating the pin was our key to success in both.

Aerial Photography Technology, Old and New

By: Mitch Bloomquist and James Baty | Concrete Foundations Association

Drone image capturing the Aerie Residence, 2017 Overall Grand Project of the Year from the Concrete Foundations Association. Photo courtesy of Ekedal Concrete, Inc., Newport Beach, CA.

Drones continue to be a very hot topic these days. Whether you attend World of Concrete, pay attention to the news media or pay attention to the photos posted throughout social media, the age of drones is here. The news offers a wide variety of perspectives, from a viral image captured during the royal wedding of Prince Harry and Meghan Markle to hijacked drones on the 2014 season of the hit TV show 24, to Amazon announcing plans to use drones to execute same-day deliveries. The technology is making its way into more and more hands. In the construction industry, some contractors are beginning to experiment with drones and aerial photography. This fascination with the bird’s eye view is nothing new, though. People have been going to the extreme to capture these images for over one hundred years.

According to the Professional Aerial Photographers Association (PAPA), French photographer and balloonist, Gaspard-Félix Tournachon patented the idea of using aerial photographs in mapmaking and surveying in 1855, and he took the first known aerial photograph in 1858. The photo was a view of the French village of Petit-Becetre taken from a tethered hot-air balloon, 80 meters above the ground. Technology at the time required a complete darkroom to be carried in the basket of the balloon.

As it often does, technology changed quickly. In addition to hot-air balloons, early pioneers employed rockets, kites and even pigeons to carry their equipment up into the air. English meteorologist E. D. Archibald was among the first to take successful photographs from kites in 1882, but George R. Lawrence took perhaps the most famous photograph in 1906. Using a heavy, large-format camera attached to a string of 17 kites flying 2,000 feet above the city of San Francisco, Lawrence documented the devastation after the 1906 earthquake and fire that destroyed over 80 percent of the city.

Dr. Julius Neubronner was a German photographer reported to have invented a breast harness for pigeons. In 1907, his harness was capable of holding a camera with two lenses. Rather than relying on the pigeon to snap the shutter, Dr. Neubronner devised his invention to be inflated with air. As the pigeon flew, the air would slowly leak, and once all the air was gone, a piston-actuated shutter would move and take the image. Read more on Neubronner.

Wilbur Wright captured the first image taken from an airplane in 1909, and aerial photography soon replaced sketching and drawing by aerial observers during World War I. Following the war, the aerial camera was turned to non-military purposes and quickly proved to be a successful commercial venture.

Today, airplanes are still used regularly for aerial photography and are often employed by contractors to capture progress shots of projects throughout the construction process.

Not to be outdone, CFA members have creatively employed equipment to take photos of residential foundations for years. While knuckleboom cranes are not likely “OSHA-approved”, for aerial manlifts, the form basket became a popular “cage” to send someone high in the air to capture the impressive and complex geometry.

Photo caption: Randy Groome contributed great aerial photos, taken for projects his

company submitted to the CFA Projects of the Year, using a knuckleboom crane and form basket with lanyard. Photo courtesy of Balmer Brothers Concrete Work, formerly of Akron, PA.

Over the last couple of years, participants in the CFA’s annual Projects of the Year

competition have been proving the value of the new photography option that is quickly gaining in popularity: drone photography. According to Dave Sheppard with SCW Footings & Foundations Inc. of Salt Lake City, Utah, there is much to be gained from acquiring a drone for your business.

“Technology is an ever-changing and ever-advancing thing in today’s world,” states Sheppard. “The construction industry is no exception to that fact. From the engineering and design behind the projects to the application and execution of them, technology is always at the forefront of a

Randy Groome contributed great aerial photos, taken for projects his company submitted to the CFA Projects of the Year, using a knuckleboom crane and form basket with lanyard. Photo courtesy of Balmer Brothers Concrete Work, formerly of Akron, PA.

successful project. We at SCW Footings & Foundations use complex AutoCAD software to draw our foundations. We use state-of-the-art robotic layout machines to properly place our foundations. And we use the newest and most effective tools and machines to build our foundations to the best possible standard.”

The most recent drone purchased by SCW is the DJI Mavic Pro. “This drone is the state-of-the-art technology available to the public,” states Sheppard. He says the Mavic Pro is nimble, agile and rock steady. “Along with the flight capabilities of the drone, it comes standard with a fully controllable 4K camera for still pictures and video. This allows us to get any and all angles of our work photographed in order to showcase our finished product. We are very pleased that we chose to purchase a drone. The Mavic Pro sells for under $1,000 and requires little to no maintenance/upkeep. It is well worth the cost, and we would recommend it to any and all contractors looking to further their advertising game.”

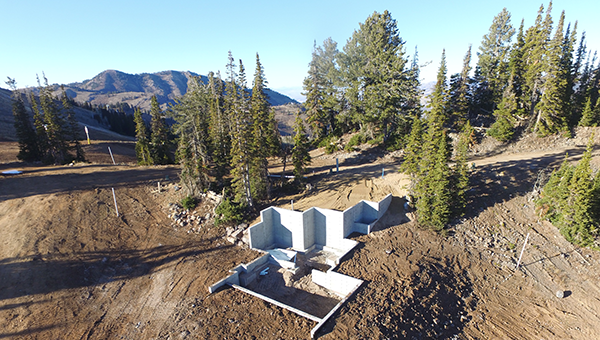

The drone photography for this “under 2,000 square feet” and remote project contributed to the award recognition it received in 2017. Photo courtesy of SCW Footings & Foundations Inc., Salt Lake City, Utah.

According to Shepherd, the drones prove themselves over and over again as people discover new applications and find ways to save time and improve safety. Drones have highly influenced photography. These photos not only bring striking shots to present and archive finished work, but also their photos are used to investigate quality control and inspect their installations. “We pride ourselves in building and pouring the most difficult and impressive residential foundations in the industry,” Sheppard says. “In any market nowadays, being able to visually showcase a product is key. If it’s attractive, odds are people will want to buy it. Footings and foundations get thrown on the back burner fairly often when it comes to the overall glamour of a project. We’re doing our best to change that. This is where drones come in. The best way to see a bunch of poured concrete in a hole is to get above it.”

Flying over sites prior to bidding a job allows them to document and study existing conditions, including access to the site. President of SCW, Kirby Justesen, offered ways they have expanded the use of drones. “On a project late last year, we sent the drone into the site to see what kind of access we might have. This provided us with the support necessary to instruct the owner that the site wasn’t buildable for what he wanted to accomplish. We are constantly pursuing ways of making us more efficient and effective at what we do.”

Whether for inspections or final photographic records, the drone takes images that are much more difficult or even impossible to capture with traditional means, such as this mountain foundation. Photo courtesy of SCW Footings & Foundations Inc., Salt Lake City, Utah.

Herbert Construction Co. of Marietta, Georgia also has begun using drone technology in their business. “We used to hire an aerial photographer in an airplane for our really big projects,” said Doug Herbert, the company’s president. He is convinced those aerial photos helped his company win some of their CFA Project of the Year awards. Those same photos are also used heavily in their marketing and sales pieces. The company bought a drone late last year and they are beginning to use it to take photos and videos. “Because of the cost of the aerial photographer, we didn’t get photos on a lot of really interesting and complex projects that we’ve done. We finally decided to get a drone and use it on a lot more of our projects.” Doug sees video footage taken by the drone to be even more valuable than the photos. He explained, “Video is the most effective marketing media right now. We plan to utilize the videos from our drone in all of our marketing.” This will include videos on their website and social media, sales videos shown and sent to prospects, and videos sent to customers showing their own project’s foundations.

Photo courtesy of Herbert Construction Company, Marietta, Georgia.

While law governing the operation of these remote-controlled pilotless aircraft will surely become more defined, there are countless conditions and spaces where flying a drone is more practical than using a full-sized helicopter or airplane. Perhaps, though, some may prefer to not get involved with the FAA registration process and maintaining authorization, and not deal with training an employee(s) on the regulated parameters encompassing drone technology.

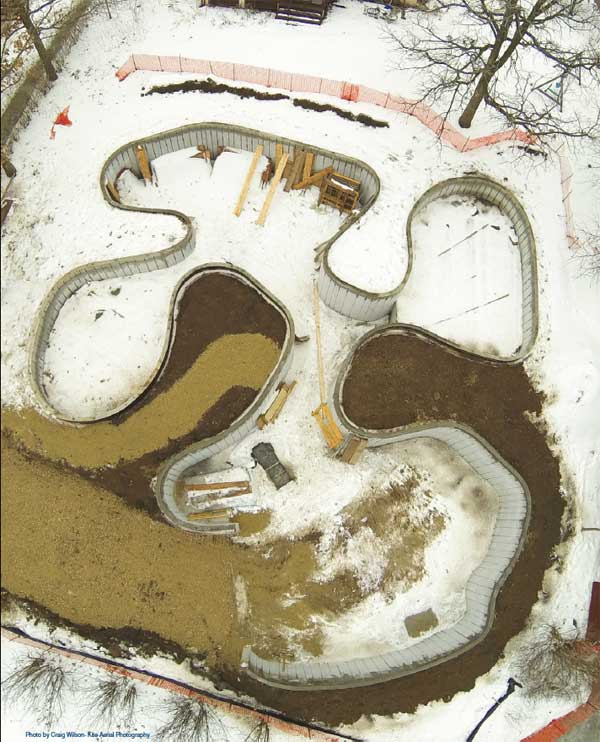

“A Badger On Her Head”, published in Hanging by a Thread: A Kite’s View of Wisconsin (2006). Photo courtesy of Craig Wilson, Kite Aerial Photography, Madison, Wisconsin.

Still, more options exist. Craig Wilson, from Madison, Wisconsin, specializes in kite aerial photography. His work has been published in a book, Hanging by a Thread: A Kite’s View of Wisconsin (2006). Published by Itchy Cat Press, the Blue Mounds imprint of Flying Fish Graphics, the book includes 140 color plates on 132 pages. The majority of the images focus on Madison, bringing new perspectives to familiar settings. A newer book titled A little More Line: A Kite’s View of Wisconsin and Beyond (2012) is also available.

A crowd close-up, published in the book “A Little More Line: A Kite’s View of Wisconsin and Beyond (2012). Photo courtesy of Craig Wilson, Kite Aerial Photography, Madison, Wisconsin

David Medaris at Isthmus, Madison, Wisconsin’s alternative news media, wrote, “Where satellite images are static, remote and gridlike in composition, Wilson’s kite cam affords a more human-scale acuity, full of color and life and artistic intent that is beyond the ability of even low-flying surveillance craft.”

Wilson’s camera is mounted to a kind of homemade armature that hangs a good distance below the kite itself, which flies smoothly high up in the air. Surprisingly, very little wind is needed to get the kite and equipment up into the air, according to Wilson.

Some of Wilson’s most impressive images are his aerial close ups. Ron McCrea wrote in Capitol Times, “It’s unusual because images from a kite often get oddly close to crowds and buildings at a medium altitude, using normal lenses that capture detail and lifelike effects that a long-lens photo taken from a helicopter simply can’t replicate without distortion.”

A CFA member, Hottmann Construction of Madison, Wisconsin can corroborate the effectiveness of kite photography. Perhaps you will recall their astounding Grand Project of the Year from 2014 with the serpentine foundation. “Located here in the Heartland, farming is a large portion of our industry,” states Mike Thole, vice president for Hottman. “Every farm I visit seems to have an aerial picture of the owner’s farm somewhere in the house. They are typically taken from a plane. I had the idea that it would be cool to have an aerial shot of this project, but the location would not allow for a picture from a plane. I researched a bit and found Craig Wilson and his kite aerial photography.”

Taken by kite photography, this foundation could not have been photographed by any ground-based physical means, and drones were not yet providing high-resolution images. Photo courtesy of Hottmann Construction, Madison, Wisconsin.

A kite is not subject to the restrictions imposed on planes, helicopters or even drones. Wilson can fly his camera directly over a crowded stadium, within feet of the tops of buildings, or just above the heads of people enjoying lunch at a café. He celebrates the fact that time is not so much of an issue with kite photography. There are no expensive rental fees and battery life is not a concern. An airplane cannot practically hang around all afternoon to wait for the perfect light or site conditions.

Wilson was brought in to feature the construction of a home built into a 100-year-old neighborhood where access was nearly impossible due to the closeness of surrounding property lines. Not only was it successful, but also it was the best way to tell the incredible story of this foundation construction.

Whether you prefer the high-tech drone or the nostalgia of a kite, one thing is certain: the versatility and flexibility afforded by these options is of great value in telling the story of your projects and conveying the craftsmanship, artistry and perhaps even a bit of the insanity of the work you produce.

Increase Profits by Creating Systems in Your Company

Let me ask you a personal question. When you wake up in the morning and you get ready for work, do you always do things in the same order?

Here’s what I mean: When I wake up on a weekday, I do the same tasks in the same order, every time. I first grab my phone to look at the weather and see what I have scheduled for the day. I then take a shower and dry off, use Q-tips in my ears, put deodorant on, put my contacts in, brush my teeth, fix my hair, get dressed and head out the door.

I do the same routine every time and don’t even think about it. In fact, my mind is on the day ahead. I’m wondering if we got that inspection, allowing us to pour concrete, and if all of our drivers are going to show up today. I’m trying to decide which guy we can move up to be a wall foreman. I’m thinking about how we can reduce our labor costs. I’m reminding myself to follow up on that estimate we sent out. And on and on.

I was not thinking about how much toothpaste to put on the toothbrush. I did not have to remember to scrub my armpits while taking a shower. All of those things happened automatically because I made a system out of getting ready for work. I made a repeatable process from my morning tasks of getting ready for work. Because of that, I do the same thing every day and never miss a task. In fact, if I took a video of my morning routine (which, I know, nobody wants to see that), I bet I would wash my hair, apply deodorant, and brush my teeth with almost the exact same number of movements.

And my guess is, you do the same thing. You have a specific routine every morning that you do like clockwork. And, you are thinking of a whole bunch of other things while you are doing it. You, too, have a system for getting ready for work in the morning.

So, what if you had systems like this in your business that your people followed every time? What if you had processes in place where tasks were done the same way, no matter who did them? Would that make you more productive? Would that eliminate costly mistakes? Would that allow you to delegate some of your work to other people? Would it make you more money? It certainly would!

Doug Herbert brings a powerful sales and marketing focus to Concrete Foundations Convention, speaking on “Increase Profits by Creating Systems in Your Company” – Zermatt Resort, Midway, UT – July 19-21, 2018

This summer at the CFA Convention in beautiful Midway, Utah, I will be giving a presentation: Increase Profits by Creating Systems in Your Company. During that presentation I’m going to show you how to create systems in your company.

Having systems in your business allows you to:

- Increase productivity

- Reduce mistakes

- Ensure things are being done the right way every time

- Grow your company and get to the next level

- Increase profitability

- Delegate some of your work to others in the company

- Have more time to do other things (like see your kid’s ball game)

You will walk away from my presentation with a clear understanding of how to implement systems in your concrete construction business.

Here are some of the things you’ll learn:

- How to identify what areas of your company can benefit the most from having a system

- Specific steps required to build an effective system in your business

- How to implement each system for the best results, with buy-in from everyone involved

- A way to establish a follow-up process to make sure new systems stay in place

This is the same presentation that the World of Concrete organizers have hired me to do several times, with my largest audience there being exactly 300 people. However, this is a new and improved version of my World of Concrete presentation, one that I’ve created just for the attendees of the CFA Convention.

If you’ve wanted to come to the Convention before but you just didn’t think you could be away from your business for that long, that is probably a sign that you don’t have systems in place that let people know what do to when you aren’t around. You need to have your business set up so it can run without you for at least a few days. You can do this by having systems in your business. If you come to the Convention, I can show you how to set up these systems in your business.

There will be many great speakers at this event who you and I both can learn from. But the best part of the CFA Convention is that you get to talk with other concrete contractors just like you. They experience the same challenges and problems that you do every day. And some of them have come up with some great ways to fix those challenges.

Every time I go to a CFA event, I learn things from other contractors that I take back to my business and profit from. You will do the same thing…but only if you attend! So, don’t delay. Don’t procrastinate. Don’t wait and see if you’ll be able to swing it. Just sign up today. Book your room. Get your flights. Discuss the trip with your family; and do your best to make it happen! Trust me, you’ll be glad you did.

Doug Herbert is President of Herbert Construction Co., one of the largest residential concrete contractors in the southeast. Doug is a regular presenter for the CFA and World of Concrete. He is the Founder of ProfitableContractor.com where he shows concrete contractors how to reduce their costs and increase their profits with effective sales and marketing systems. Reach Doug at Doug@ProfitableContractor.com

Dealing With the Reactivity of Aluminum Forms and Concrete

By Destry Kenning, Forming Market Segment Manager, Nox-Crete Products Group

Part 1 of a 4-Part Series

Anyone who has placed concrete against new or older reconditioned and not properly seasoned aluminum forms is most likely familiar with the veins or worm-like trails that form in the resulting concrete, and also familiar with the excessive concrete buildup that occurs on the form surfaces. These problems occur because the elemental aluminum present in the aluminum forms is very reactive with the cementitious materials in concrete. Unfortunately, these problems typically continue for three or four additional pours, and possibly even longer depending on the method used to deal with buildup on the form surfaces.

As mentioned, elemental aluminum reacting with the cementitious materials results in concrete buildup on the form surfaces. This buildup occurs because of shared chemical bonds between the aluminum and the cementitious materials. These chemical bonds are different and much stronger than the physical bonds that might result if, for example, no release agent is used on a nonreactive form surface. Concrete buildup as a consequence of chemical bonding is much more difficult to remove than buildup from a physical bond.

Another effect of this reaction is the presence of hydrogen gas, which creates bubbles on the formed, freshly placed, concrete surfaces. By migrating upward and escaping out of the top of the wall, these bubbles ultimately create the all-too-familiar veins or worm-like trails. It is important to note that the hydrogen gas bubbles are not likely to form bugholes in the concrete like those caused by entrapped air. Hydrogen gas bubbles weigh much less than the air we breathe and therefore tend to migrate up the wall much easier than does entrapped air.

Elemental aluminum reacting with the cementitious materials in concrete produces hydrogen gas, which causes veins or worm-like trails in the surface of the concrete – Photos courtesy of Precise Forms Inc. and Carroll Construction Supply/Dalaco.

There are steps you can take to prevent these problems. One option is to apply some type of resinous coating on the aluminum form surfaces.

A heavy coating or application will create a barrier between the aluminum form surfaces and the concrete, eliminating the potential for a chemical reaction between the two. However, the coating will ultimately succumb to the abrasion and scratching that occurs during the handling and transport of aluminum forms, and to the abrasion caused by repeated concrete pours against the form surfaces. Reapplication of the same coating becomes far more challenging because the remainder of the existing coating typically needs to be removed, along with any concrete buildup or form release agent residual that might interfere with the adhesion of the second coating application.

A thin coating or application is sometimes suggested. There is the understanding that it will wear out fairly quickly, but it has the advantage of minimizing the amount of elemental aluminum that can react with the concrete in any one pour. The idea is that this will reduce the amount of concrete buildup on the form surfaces and surface irregularities in the poured concrete.

Unfortunately, both coating methods are little more than temporary solutions, as they do not mitigate the underlying reactivity of the elemental aluminum. Once the coating is gone, the same problems remain.

A more effective method for dealing with the elemental aluminum is to make it react with something in advance to prevent or greatly minimize any further reaction when concrete is placed against the form surfaces. The idea is to convert the elemental aluminum on the form surfaces to aluminum oxide, a process typically done with an alkaline solution or slurry. This process is frequently referred to as “seasoning.”

Seasoned aluminum form on left, unseasoned on the right – Photo courtesy of Precise Forms, Inc.

One seasoning method is the field application of a lime slurry. Contractors have been doing this for years; however, this method has been met with mixed results and is far from 100 percent effective in dealing with the aluminum reactivity.

An alternative and more effective option than the traditional lime slurry, is to utilize a product that is specifically designed for the aluminum form seasoning process. These proprietary products are also field applied, but they are typically more reactive than lime and therefore more effective in converting the elemental aluminum to aluminum oxide. To ensure positive results, some of these products also contain cleaning agents that remove mill oil or grease frequently found on new aluminum forms.

Even though these proprietary products perform much better than the traditional lime slurry, they are still not 100 percent effective. Also, as with the lime slurry method, these treatments will need to be combined with highly reactive form release agents for the first few pours to achieve the best results.

Temperature sensitivity is an issue for both the traditional lime slurry and the proprietary products. If the form temperature drops below 70° F, the effectiveness decreases. By the time form temperatures are in the 40s, the results are typically poor. This does not necessarily mean that you cannot complete the process at air temperatures below 70° F. In fact, the form temperature is more important than the air temperature. If the forms are laid out in direct sunlight, they will typically heat up well beyond the air temperature in a short period of time.

The final method for seasoning involves the submersion of the entire form in a tank filled with a proprietary product specifically designed for the seasoning process. This method requires great care and understanding of the process, as it is quite hazardous and could easily result in form damage or worker injury. For these reasons, this process is generally done by the aluminum form manufacturers in a controlled environment. That said, there are only a couple of aluminum form manufacturers that actually offer this service.

Of the three seasoning methods described, the dip tank method is the most effective for seasoning aluminum forms, but it also typically costs the most. The dip tank method should be followed by the use of a highly reactive release agent for the first few pours, to complete the seasoning process.

Regardless of the seasoning method used, it is always a good idea to use a highly reactive release agent and a low alkali content concrete mix for the first few pours. A low alkali concrete mix can be achieved with a low alkali cement and/or through the use of certain mineral admixtures, such as Class F fly ash. Local ready mix concrete producers should be able to assist the contractor in meeting this requirement.

During the first few pours after the forms are initially seasoned, it is good to avoid the use of calcium chloride in the concrete. Also, next-day form stripping in cold weather conditions should be avoided.

Lastly, the aluminum oxide layer that develops on the aluminum form surface during the seasoning process is very thin and somewhat delicate for the first few pours. Accordingly, extra care must be taken during these initial pours to prevent excessive abrasion and scratching during concrete placement against the aluminum forms, as well as during the handling and transport of the forms.

For more information about form seasoning, please visit www.nox-crete.com or contact Destry Kenning at DKenning@nox-crete.com or 402-504-9232.