RISK Management: You Have The Job!

But is your insurance coverage what it should be?

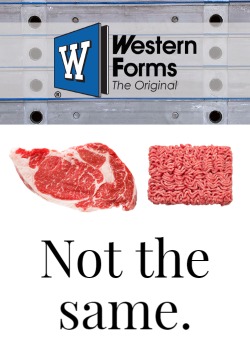

“You have the job!” You are off to the races. It is astonishing that subcontractors often commence work on a project without defined terms of indemnification or having matched their insurance coverage with the indemnification terms of the contract. We have all heard the stories about insurance companies paying claims for no reason or when they should not have been paid. However, if you really think about that statement it is ludicrous! Just think about how hard it is to get money from an insurance company when you have an automobile or a property loss. Why would the insurance company fight small nuisance claims and pay large settlements? The reality is they would not. Insurance companies’ profits are based on their ability to successfully manage claims.

The vast majority of CFA member company owners started their construction business because they were excellent in the trade of concrete. This is why owners need to rely on professional partners. In today’s world being excellent in a trade is only a small a part of running a construction business.

Many times insurance companies are obligated to pay claims because of the contracts you sign daily. The indemnification clauses that are financially backed by your insurance policies leave the insurance carriers little wiggle room to walk away from claims when they happen. Which is a good thing, because if they did walk away you would be held liable for breach of contract. Former CEO of Arthur J Gallagher, Bob Gallagher, made a statement that still holds very true today, “If it’s not in writing it’s not in this world.”

Many times insurance companies are obligated to pay claims because of the contracts you sign daily. The indemnification clauses that are financially backed by your insurance policies leave the insurance carriers little wiggle room to walk away from claims when they happen. Which is a good thing, because if they did walk away you would be held liable for breach of contract. Former CEO of Arthur J Gallagher, Bob Gallagher, made a statement that still holds very true today, “If it’s not in writing it’s not in this world.”

In order to reduce your insurance costs, you have to show the insurance carrier that you are at the top of your game when it comes to contracts. It is no secret that owners and general contractors are notorious for writing one-sided contracts. You have to outsmart them.

The construction industry is encumbered with complicated indemnification and insurance requirements. Today’s contracts have advanced; they have become controlled by methods to dismiss general contractors’ and owners’ liability and transfer risk to the lower tier subcontractor. Typically, terms reflect a set of conditions that a subcontractor will accept as a matter of business convenience, or worse, because it was the only way to be awarded the contract.

The practice of beginning the work on a job site then waiting and seeing what happens or how the site is going to be managed has created an atmosphere ripe for mistakes. Far too often we see the subcontractor accepting indemnity and insurance requirements without consulting with its professional advisors before complying with that responsibility.

The entire contractual indemnification process creates an unknown atmosphere for insurance carriers, this in turn makes them more cautious about their construction contractual risk. The more uncertainty an underwriter has to account for in an insurance program the higher the cost of insurance becomes. So ask yourself, as a CFA member what can you do?

- Do not make mistakes on the obvious

- Make sure the terms are in writing before you start work

- Have an insurance professional review the contract to make sure the indemnification requirements are covered under your insurance policy

- Band together to create a best practice for contract reviews concerning indemnification clauses

- Pass on as much or all of your contractual risk to subcontractors when contracting work

- Communicate the terms within the contract to your field staff, some contracts have notice of claims or incident requirements

Construction liability claims tend to take time to marinate. Often times claims do not illustrate their severity until two to four years after completion of work or when an injury occurred. An example of this which pertains directly to you as a CFA member is, residential construction completed operations claims; these types of claims tend to be low frequency with high severity. The majority of the costs associated with such claims are defense costs relating to the indemnification requirements in the contract. Those indemnification requirements typically include an additional insured endorsement. To defend a client, it costs the insurance company $50,000 to $75,000 in legal defense per claim.

While the subcontractor in the claim might not be negligent, the exposure is widespread because the insurance carrier must defend all additional insured parties. Thus, making this type of claim a valid cost exposure in the eyes of the insurance carrier regarding your contract risk. Some ways you can avoid negligence in the event of a claim is by doing the following:

- Record retention policy

- Daily job logs

- Investigate all incidents

- Document everything with the general contractor and/or owner

Trouble really begins for a subcontractor when it finds itself with a gap in coverage resulting in the insurance carrier denying the coverage request of an additional insured. Insurance policies include exclusions in many sections of the policy: definitions, exclusions, other insurance clauses, and coverage sections. Are you requiring a review of your policy from your current broker? As an example, in recent years’ insurance carriers have moved to exclude coverages and contracts seek wording to include those very items that are excluded putting subcontractors in the middle.

Price is an important factor when purchasing commercial insurance coverage, but it is not and should not be the number one consideration. Coverage, carrier and agent construction industry knowledge should always be considered first because this will ultimately have an effect on your price.

Coverage

Typically we see the majority of the claims in the construction industry long after the project is completed because it takes claims three to five years to develop. To protect themselves, Insurance companies keep adding in exclusions…and to protect themselves owners keep requiring more coverage in the contracts. When a subcontractor is sued for something covered by its insurance policy, the insurance company will normally provide the legal defense and pay any settlements. What is problematic for subcontractors is that they have no influence over the decisions their insurance company makes. Failure to procure the appropriate insurance coverages could be a very costly mistake for a subcontractor and expose them to legal liability for breach of contract.

Carrier

Some insurance carriers are developing products to address the evolving additional insured, primary non-contributory, independent contractor coverages, etc. Other carriers are looking for ways out of the coverages because of the exposure they create when a claim occurs. Insurance companies have the ability to draft their own endorsements making the meanings in each company’s policies and endorsements different. This is big problem for subcontractors. It is possible that lesser priced coverage is lesser coverage. Knowing the intent behind the endorsements and coverage that have key limitations is important because they impact how your coverage will respond.

Agent

By and large, E&O policies that cover the professional errors of insurance agents are a claims-made policy and generally include defense costs within the policy limits. In simple terms, the cost to defend erodes the amount of money available to you if an error impacts your business. Have you ever asked your agent for a certificate of insurance or what your protection is in the event of an agent’s error?

Your Subcontractors

Do you have a written contract with your subcontractors? Are you effectively passing the indemnity and insurance requirements to your lower tier subcontractors? Many contractors trust the other contractors that are part of its operations and trust that they will each deal with one another fairly in the event of conflict without the written contract. This is a problem because once a 3rd party liability exposure exists outside parties enter the picture. The legal system affords outside parties their day in court and as stated earlier, the subcontractor has no control over the insurance carrier’s coverage decisions.

The vast majority of CFA member company owners started their construction business because they were excellent in the trade of concrete. This is why owners need to rely on professional partners. In today’s world being excellent in a trade is only a small a part of running a construction business.

Kristen Long

A.J. Gallagher

Thanks for the tip about avoiding negligence. Concrete contractors can have it pretty difficult. A friend of mine works in construction pouring concrete. I’ll have to show him a copy of this post. Thanks for sharing!